Effective Forex Day Trading Strategies for Success

Day trading in the Forex market offers immense potential for profit, but it requires discipline, strategy, and a sound understanding of market mechanics. In this article, we delve into various Forex day trading strategies that have proven effective for traders worldwide. Whether you’re a novice or an experienced trader, these strategies can help enhance your trading performance. Don’t forget to explore the forex day trading strategies Best Saudi Brokers to facilitate your trading experience.

Understanding Forex Day Trading

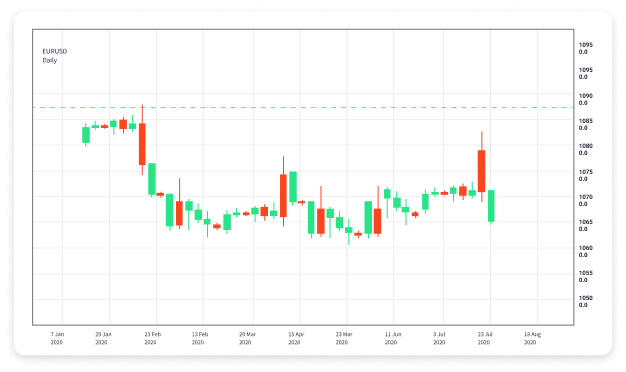

Forex day trading involves buying and selling currency pairs within the same trading day, aiming to capitalize on short-term market movements. Unlike long-term trading, where positions might be held for days, weeks, or even months, day traders close all their positions by the end of the trading day to avoid overnight risks. Successful day trading requires a blend of technical analysis, understanding market trends, and effective risk management.

Key Strategies for Day Trading in Forex

1. Scalping

Scalping is a prevalent day trading strategy that focuses on making small profits from a high volume of trades throughout the day. Scalpers often hold positions for a few seconds to a few minutes, capitalizing on minor price fluctuations. This strategy requires a high level of concentration and a robust trading plan to manage spreads and transaction costs effectively.

2. Momentum Trading

Momentum trading involves identifying trends based on market momentum. Traders use technical indicators such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) to determine the strength of a trend. Entering a trade when a currency pair shows strong momentum allows traders to ride the wave until signs of a reversal appear. This strategy can yield significant rewards, but it also entails substantial risk if the momentum shifts unexpectedly.

3. Breakout Trading

Breakout trading focuses on entering a position when the price breaks through a predefined support or resistance level. Successful breakout traders look for high volume accompanying the breakout, indicating a strong potential for further movement in the direction of the breakout. It is crucial to set stop-loss orders to minimize losses if the breakout fails to hold.

4. Range Trading

Range trading is a strategy that capitalizes on price oscillations within defined support and resistance levels. Traders identify these levels and look to buy at the support level while selling at the resistance level. Range trading can be particularly effective in stable market conditions and requires good discipline to stick to predetermined levels.

5. News Trading

Forex markets are highly sensitive to news and economic releases. News trading involves capitalizing on the volatility that follows significant news announcements, such as interest rate changes, employment data, or geopolitical events. Successful news traders prepare in advance by studying calendars and evaluating potential currency pair responses to various scenarios.

Essential Tools for Day Traders

Successful Forex day traders utilize a variety of tools to enhance their trading strategies:

- Technical Analysis Tools: Charts and indicators like moving averages, RSI, and Bollinger Bands help traders make informed decisions based on price action.

- Economic Calendars: Stay updated with upcoming economic events that can impact the Forex market.

- Trading Platforms: Choose a user-friendly trading platform with advanced features such as real-time data, customizable charts, and risk management tools.

- Demo Accounts: Practice your strategies on a demo account before investing real money. This allows you to refine your skills and discover what works best.

Risk Management Techniques

Risk management is crucial for long-term success in Forex day trading. Key strategies include:

- Setting Stop-Loss Orders: Always place stop-loss orders to limit potential losses on each trade.

- Position Sizing: Determine the appropriate trade size based on your capital and risk tolerance.

- Use of Take-Profit Levels: Set predefined profit targets to secure gains before market volatility erodes them.

- Reviewing Performance: Regularly assess your trading performance to understand what strategies yield results and what needs adjustment.

Final Thoughts

Forex day trading can be a rewarding but challenging endeavor. By employing effective strategies, utilizing the right tools, and focusing on risk management, traders can enhance their chances of success. Start with a clear plan, be disciplined in your execution, and always be willing to adapt to changing market conditions. As you hone your skills, consider leveraging reputable brokers, such as the Best Saudi Brokers, to facilitate your trading journey.