In recent years, online trading has gained immense popularity in India, with various platforms emerging to cater to the unique needs of traders. One such platform that has made significant strides in this space is Pocket Option in India. This article aims to provide a comprehensive overview of Pocket Option, discussing its features, benefits, and how it has become a favored choice among Indian traders.

What is Pocket Option?

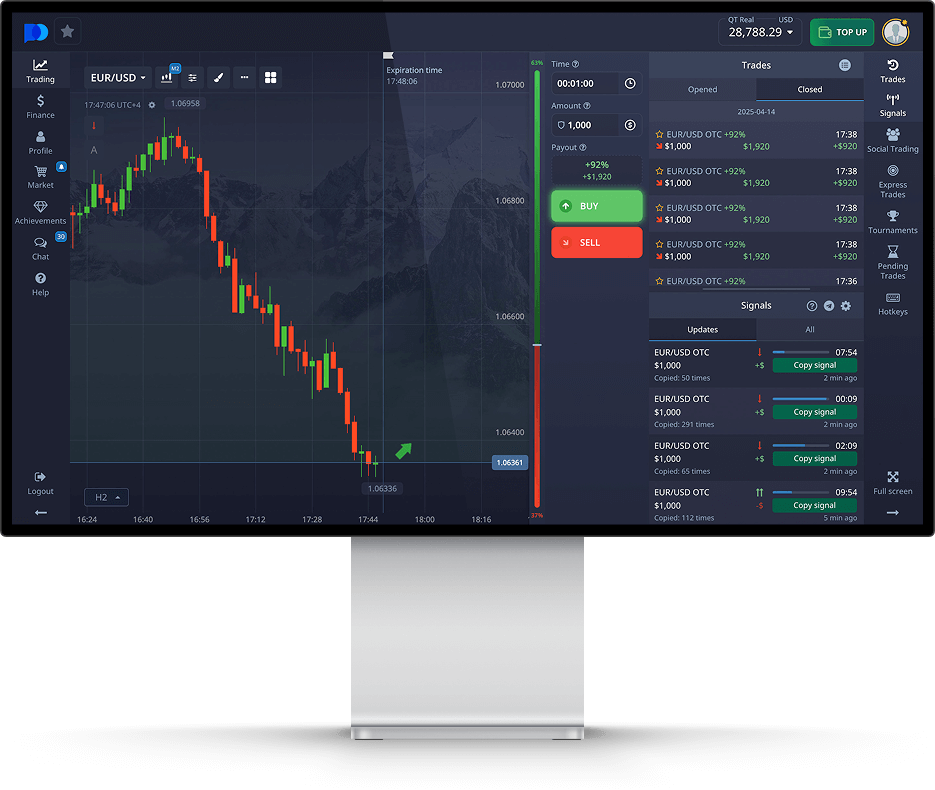

Pocket Option is a trading platform that allows users to trade various financial instruments, including binary options, Forex, and cryptocurrencies. Established in 2017, it quickly gained traction due to its user-friendly interface and innovative features. Designed for both beginners and experienced traders, Pocket Option has become a go-to option for those looking to engage in online trading.

Key Features of Pocket Option

User-Friendly Interface

One of the standout features of Pocket Option is its intuitive and easy-to-navigate interface. Traders can quickly familiarize themselves with the platform, allowing them to focus on their trading strategies rather than figuring out how to use the platform itself.

Wide Range of Assets

Pocket Option offers a diverse selection of assets for trading. From popular currency pairs like EUR/USD to cryptocurrencies like Bitcoin and Litecoin, traders have ample opportunities across different markets. This variety allows traders to diversify their portfolios and mitigate risks effectively.

Low Minimum Deposit

The platform is particularly appealing to new traders due to its low minimum deposit requirement. With as little as $10, anyone can start trading, making it accessible for many aspiring traders in India.

High Payouts

Pocket Option boasts competitive payout rates, which can go as high as 90% on successful trades. This potentially high return on investment is a significant draw for traders looking to maximize their earnings.

Multiple Deposit Methods

Understanding the diverse payment preferences of Indian traders, Pocket Option supports various deposit methods. Users can deposit funds using bank transfers, credit/debit cards, and popular e-wallets, making transactions seamless and convenient.

Demo Account

For those new to trading or looking to test strategies without risking real money, Pocket Option offers a demo account. This feature allows users to practice trading in a risk-free environment, gaining valuable experience before moving on to live trading.

Benefits of Trading on Pocket Option in India

Regulatory Compliance

Pocket Option operates under the regulations of the International Financial Market Relations Regulation Center. While it is not regulated by Indian authorities, the platform’s international compliance provides a level of assurance to traders regarding the safety of their funds.

24/7 Customer Support

Access to reliable customer support is crucial for any trading platform. Pocket Option offers 24/7 customer service via live chat, email, and social media. This ensures that traders can resolve any issues or inquiries promptly, enhancing the overall trading experience.

Educational Resources

Pocket Option understands the importance of education in trading. The platform provides numerous educational resources, including webinars, tutorials, and trading strategies, to help traders improve their skills and make informed decisions.

Social Trading

One of the unique features of Pocket Option is its social trading capability, where traders can follow and copy the strategies of more experienced traders. This can be particularly beneficial for beginners looking to learn from successful traders while growing their portfolios.

Getting Started with Pocket Option in India

Step 1: Sign Up

To start trading on Pocket Option, the first step is to create an account. The registration process is straightforward and requires only basic information such as email and password. Once registered, users can proceed to verify their accounts.

Step 2: Make a Deposit

After account verification, traders can deposit funds into their accounts using one of the many available payment methods. It’s recommended to start with the minimum deposit to familiarize oneself with the platform.

Step 3: Explore the Platform

Before diving into live trading, it’s wise to explore the platform thoroughly and utilize the demo account to practice. This will help traders understand various aspects of trading and develop their strategies.

Step 4: Start Trading

Once comfortable with the platform, traders can begin live trading. Setting clear goals, managing risks, and maintaining discipline are essential components of a successful trading journey.

Conclusion

Pocket Option has emerged as a popular trading platform in India, offering a variety of features that cater to both novice and experienced traders. With its user-friendly interface, diverse assets, and supportive community, Pocket Option provides a conducive environment for trading. As with any investment, it is essential to conduct thorough research and develop a solid trading strategy before committing real funds.

As the world of online trading continues to evolve, Pocket Option is well-positioned to adapt to the changing landscape, making it a platform worth considering for anyone interested in venturing into the realm of financial trading in India.