If you are planning for the controlling their opportunities within the later years, here’s a good way in order to rebalance their collection. Should your investments are common in the TFSAs and RRSPs, up coming attempting to sell your current holdings acquired’t have any income tax outcomes possibly. However, selling assets inside a low-entered membership can lead to funding progress or loss, so make sure you appreciate this prior to making a switch. There’s progressively more advisers whom generate list profiles for their customers, but the majority of features high lowest membership brands (have a tendency to $five-hundred,100 per house, or maybe more). Of these with additional more compact profiles, a much better option is to construct and sustain your profile in the an on-line brokerage.

- Which have holds from the toilet once again come july 1st—and you can silver upwards regarding the 31% season thus far—We expect it will begin drawing interest once again.

- The analysis are financed because of the UI Health care Stead Family members Children’s Hospital.

- In addition obtained’t need to bother about rebalancing for individuals who hold a single-admission resource allotment ETF, or you’re also using with a robo-coach (discover less than).

Elon Musk and you can Tesla: You may Musk’s politics drain the business’s stock?

Finally, you could potentially get all the foods and you may whip-up a lunch out of scrape. Of course, the house-cooked buffet ‘s the most affordable, however, you to doesn’t indicate they’s your best option for all. For those who functions extended hours, or don’t learn how to create, or fear so much cutting discover their hands which have a cook’s blade, one of several additional options makes more feel despite the added will set you back.

- For you personally, when you’re earning (otherwise realizing) a lower income inside old age, your own last buck of income is likely taxed during the less rates than simply it absolutely was as you have been functioning.

- It’s hardly ever worth investing this type of account fees, anytime your collection is quick, prefer a zero-payment option for example Lime.

- Couch potato try an excellent about three-reel position with one spend-range, which type from informs the story regarding the standard of gameplay it has up.

- Such “all-in-one” ETFs are available in additional inventory/thread allocations for your risk tastes, and are global varied.

Word-of a single day

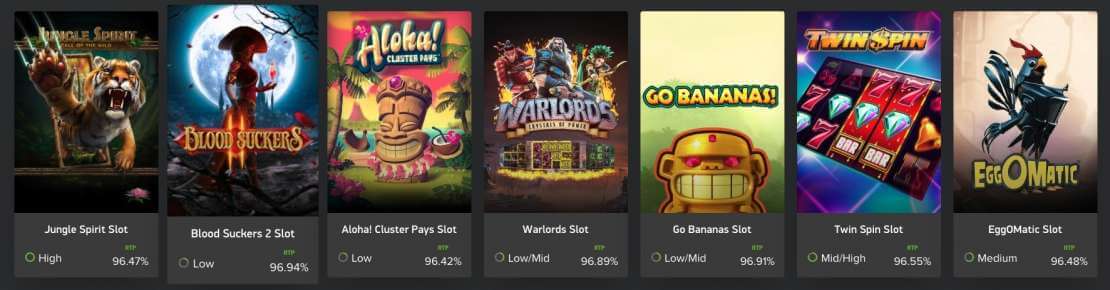

The phrase try later popularized by activities commentator Joe Moore throughout the his shows from American sporting events game. Since then, the word is section of everyday vocabulary and that is often utilized humorously to describe someone who lacks desire or physical working out. Which idiom can be familiar with determine someone who uses most of their own time sitting or prone to https://vogueplay.com/in/football-star-mgs-otr/ your a couch, watching television otherwise performing absolutely nothing. The definition of is ever more popular lately while the all of our area grows more sedentary. Regardless of the Inactive slot game becoming early, it’s nonetheless a greatest term during the of many online casinos. All you have to manage are discover a free account, try out the newest trial, and then make in initial deposit to try out your butt Potato slot machine game software.

The previous fundamentally can cost you more however, demands little to no performs, since the second tends to cost less and requires some (but not far) efforts by you. It get the text simple and for children to help you know. The new scientists identified a handful of important limitations in their investigation design.

Total, “Inactive” claims an interesting and you may fulfilling gambling experience you to definitely draws fans of conventional slots. Your butt Potato technique is quick if you’re investing in taxation-protected account for example RRSPs and you will TFSAs. But if you has a big non-inserted (taxable) membership, the best alternatives wear’t work as well. Now you you want far more freedom to be sure the profile is made inside the a taxation-efficient way.

What are exchange-replaced finance (ETFs)?

That’s distinctive from the intention of “actively addressed” common financing, and this are (usually unsuccessfully) to determine personal securities which can surpass the market. For an overview of the methods, understand our frequently questioned issues less than. A «inactive» identifies someone who leads a sedentary lifestyle and you can spends much time resting otherwise prone, typically watching tv. He could be individually dead and run out of determination to engage in physical points.

Draw provides monetary thought and you may evidence-based money management services to families inside Ontario. A firm is actually taxed in a different way than simply one in the Canada. While the somebody, we have been taxed centered on a modern taxation program, meaning highest levels of income try taxed from the higher rates. To suit your needs, when you’re generating (otherwise recognizing) a reduced earnings within the senior years, your past buck of income is likely taxed in the a lower rate than simply it actually was while you had been working. If you’lso are safe being more hand-for the, you could potentially think implementing an excellent multi-ETF design collection. This process will need one unlock a merchant account during the an excellent broker and you will perform some regular funding repair, as well as allocating dollars, reinvesting dividends and you will rebalancing.